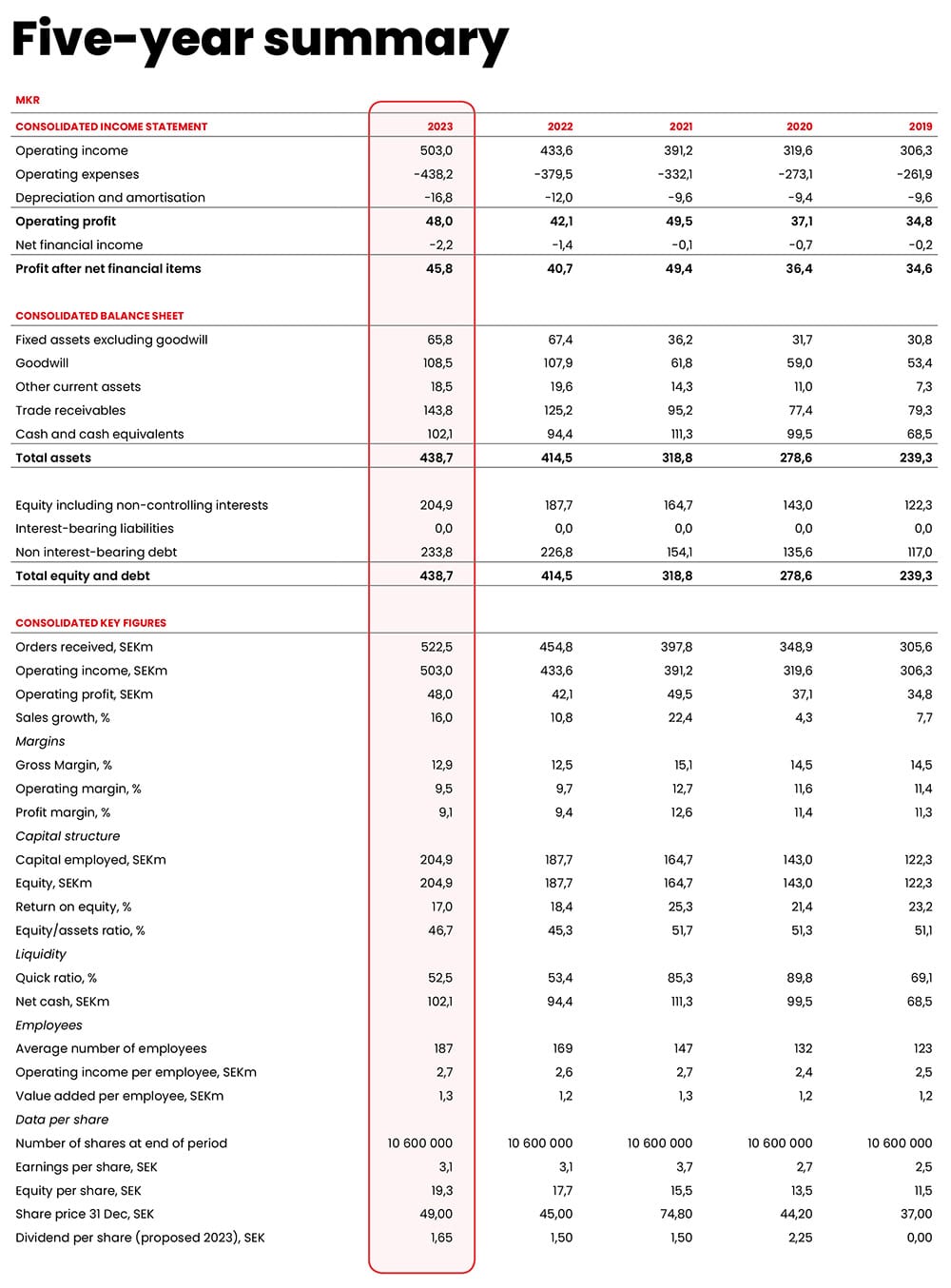

Financial data

Novotek goal is to achieve an average annual growth of 15 percent and an operating margin of approximately 10 percent over a business cycle. Parallel to this, acquisition opportunities are regularly evaluated.

Calendar

16/2/2024

Year-End Report

January – December 2023

6/5/2024

Interim report

January – March 2024

6/5/2024

Annual General Meeting

16/8/2024

Interim report

January – June 2024

7/11/2024

Interim report

January – September 2024

14/2/2025

Year-End Report

January – December 2024

Financial reports

(Only in Swedish)

Click on image to open a large version >>

Key ratio definition

Sales growth

Increased/decreased operating income excluding capitalized development exenditures.

Gross margin

Income before depreciation and items affecting comparability in percentage of operating income.

Operating profit margin

Income after depreciation and items affecting comparability in percentage of operating income.

Net profit margin

Income after financial items in percentage of operating income.

Working capital

Total assets less non interest bearing debt

Return on equity

Income after taxation in percentage of average equity.

Equity ratio

Adjusted equity in percentage of total assets.

Quick asset ratio

Net cash in percentage of short term debt.

Net cash

Cash and cash equivalents.

Average number of employees

Average number of full year equivalent employees.

Value added per employee

Operating profit and employee cost compared with average number of employees.

Profit per share

Income after tax compared with total number of shares.

Equity per share

Equity by end of year compared with total number of shares.